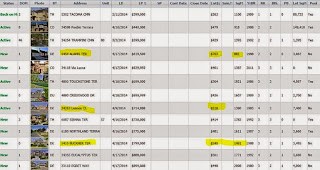

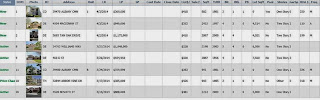

Here’s this weekend’s shopping list. Properties Priced Under $400,000 Click Here to View Listings Properties Priced Under $400,001 to $600,000 Click Here to View Listings Properties Priced Under $600,001 to $800,000 [biggest selection] Click Here to View Listings Properties Priced Under $800,001 to $1,000,000 Click Here to View Listings Properties Priced over $1,000,000 Click Here to View Listings Ones that I particularly liked: Click Here to View Listings I’ll be visiting Albany Common at 1pm. - S unil Sethi SUNIL SETHI REAL ESTATE Helping Families Find Homes with Great Schools in Fremont, Newark and Union City. Property Search | Featured Listing | Neighborhoods | Home Value | School Score | Property Tax To access most updated listings on MLS from your phone, Download my FREE app from "My Mobile App" . Want to know if you qualify for any special loan programs. Check out CAR's Mortgage Directory Love Us on Yelp! Like Us on Facebook