Should you buy today or wait for further decreases in home pricing

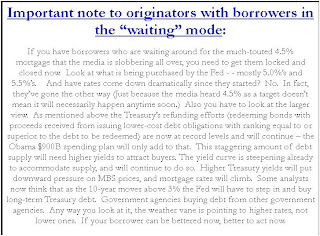

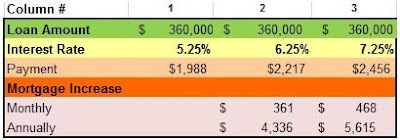

A client I worked with this last weekend, got me to thinking about how I should look at this problem. It’s all going to boil down to what you think will happen with: Your income stream (job security, ability to get another job, if your company decides it needs to downsize, etc.) Mortgage Interest Rates Property Values Obviously, renting is the safer, securer option for you right now, but the benefit of owning is that you fix your housing costs (since a 30 yr mortgage is major component of your home ownership costs, taxes are limited to increasing at 2% (California’s Proposition 13), and insurance rates have actually come down the last 2 years). I don’t think pricing will move up the next year. However we don’t know where interests maybe. One concern out there is that interest rates will be higher in the future because of money the government is printing right now will cause inflation. So the big benefit of buying today is that rates are low, and pricing is also very good. Take a look a