Should you buy today or wait for further decreases in home pricing

- Your income stream (job security, ability to get another job, if your company decides it needs to downsize, etc.)

- Mortgage Interest Rates

- Property Values

Obviously, renting is the safer, securer option for you right now, but the benefit of owning is that you fix your housing costs (since a 30 yr mortgage is major component of your home ownership costs, taxes are limited to increasing at 2% (California’s Proposition 13), and insurance rates have actually come down the last 2 years).

I don’t think pricing will move up the next year. However we don’t know where interests maybe. One concern out there is that interest rates will be higher in the future because of money the government is printing right now will cause inflation.

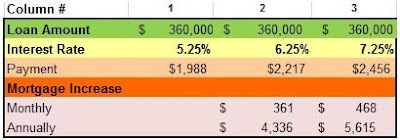

So the big benefit of buying today is that rates are low, and pricing is also very good. Take a look at Table 1

Table 1 – Impact to Monthly Mortgage with 1% increases to the Interest Rate

Today you can get a rate in the low 5%. At 5.25% your monthly mortgage would be $1,987.93. If rates increased by 1% in the future, and your monthly pmt would increase by $361/month or 18% over today’s rate. Column 3 assumes that rates increases by 2% in the future, in which case your monthly payment increases by $468/mth or 23.5% over the rate offered today.

To see how much home prices would have to drop if rates were to increase to keep you at parity, look at Table 2.

Table 2 – Drop in Home Prices required to Offset a 1% increase to the Interest Rate

So in this example home prices would need to drop 10% or 38,000 to keep the mortgage pmt the same you would get by buying today at $360,000 at a 5.25% rate.

I hadn’t done this calculation until just now, but it is interesting. I do believe that rates will rise in the future by a 1% because of inflation, however, I’m less certain that home prices will drop another 10%. It’s all going to boil down to how bad this recession becomes. If the stimulus kicks in and American ingenuity comes into play like it did after the dot=com bubble collapsed, then don’t be surprised if these media outlets all of a sudden start writing about how GDP growth and job gains.

Hope you find this information useful. Good luck in your home buying!

Sunil Sethi

http://www.sunilsethi.com/

Comments